Business apps flourish, games still dominate: the app trends of 2020

Worldwide app downloads reached an all-time high of 37.8 billion in the second quarter of 2020, an increase of 31.7 percent year-over-year. But what are people downloading? A new report by Sensor Tower reveals the app trends taking place in 2020. We sifted through the data, so you don't have to.

The COVID-19 impact on app downloads

As you may have already suspected, the coronavirus outbreak around the world had a major impact on the app landscape. Whilst cities went into lockdown and more and more of us stayed at home, we looked to the app stores for solutions to problems and opportunities that did not present themselves so visibly before the pandemic.

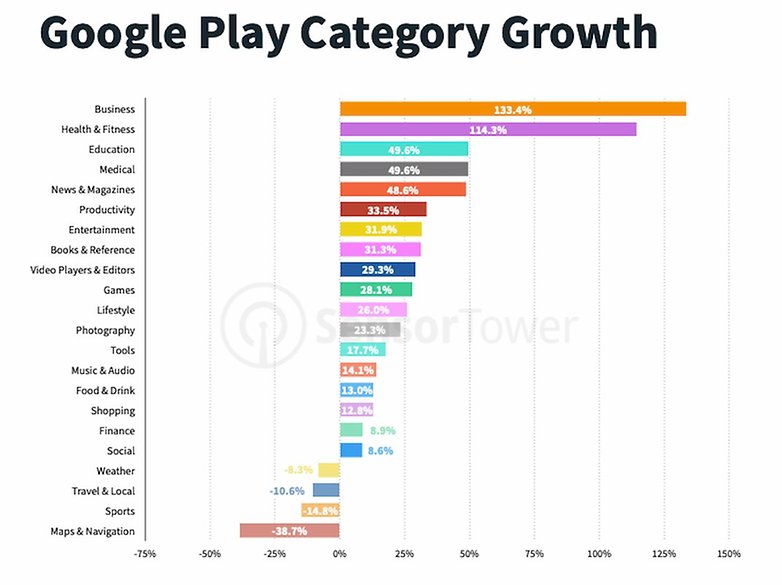

Business, health and fitness, and education apps all thrived in Q2 2020, as many of you looked to spend lockdown getting fit or learning something new. Downloads for health and fitness apps remained 20-35 percent higher than pre-coronavirus levels 13 weeks after the height of the pandemic. As populations around the world began to work more and more from home, productivity and video conferencing tools boomed.

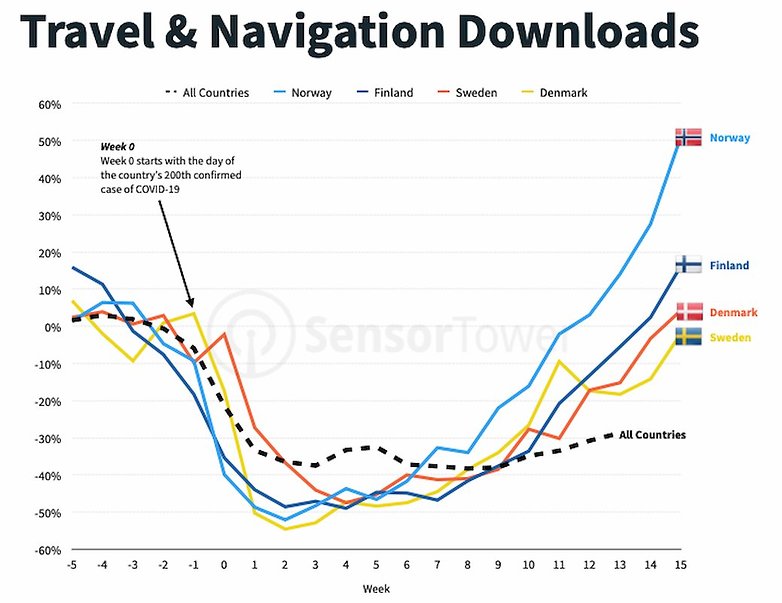

Meanwhile, travel, navigation, and sports apps naturally suffered an extended period of low installs. Travel apps, in particular, became superfluous in Q2 as borders closed and curfews and quarantines were introduced. Travel apps were more than 60 percent below pre-COVID levels in the 10 weeks following countries’ 200th confirmed case. Worldwide travel and navigation app downloads remain about 30 percent below pre-coronavirus levels, but downloads in some countries are starting to return. Scandinavian countries are showing the first signs of a return to market norms. Norway, in particular, saw huge growth in Q2, with downloads reaching 50 percent above pre-coronavirus levels.

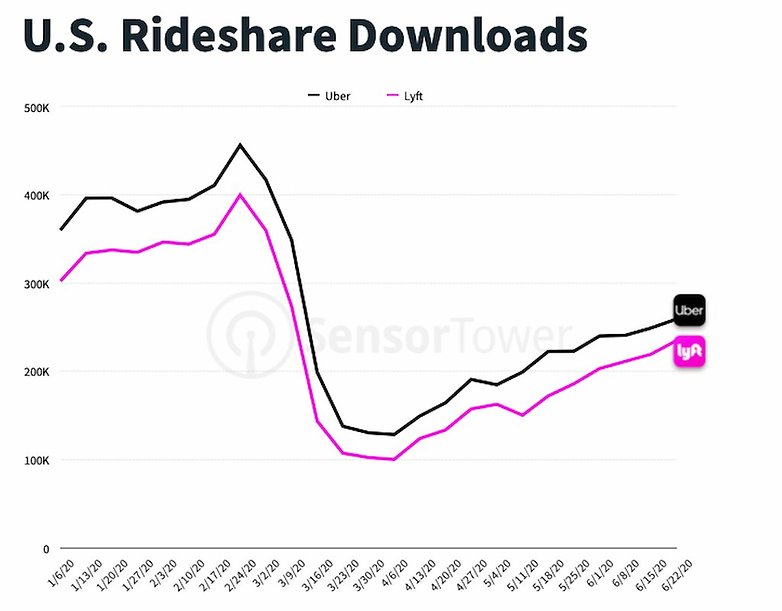

Ride-sharing apps also in Q2, understandably. The data for both Uber and Lyft matches the COVID lockdown data almost perfectly. However, after reaching a low point in early April, downloads have climbed steadily since then for both apps in the United States.

Business apps flourish

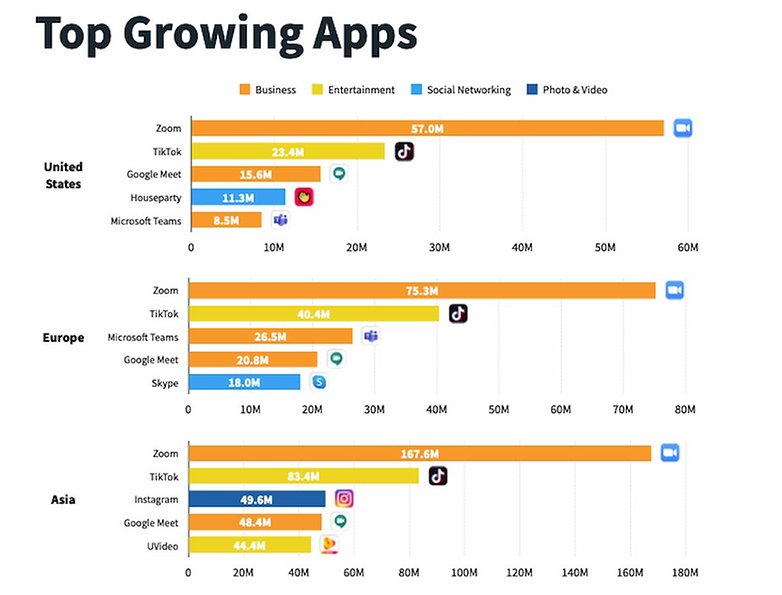

The biggest winner of this period was undoubtedly Zoom. The virtual meeting app of choice for many business, governments, and schools was the top app by downloads in the US and in Europe for the quarter. It was only the third app to reach 300 million installs in a single quarter, joining TikTok and Pokémon GO in accomplishing this milestone. Google Meet and Microsoft Teams also enjoyed all-time download highs.

Social apps like Houseparty and Skype also showed good growth, whilst downloads on Google Play’s Social category grew nine percent following COVID-19, compared to 42 percent growth for the App Store’s Social Networking category.

Games still dominate on both Android and iOS

Mobile games still account for a huge proportion of the apps downloaded on both Android and iOS. On the Google Play Store, games grew by more than 50 percent year-over-year, and nearly 20 percent quarter-over-quarter from its previous high of 10.4 billion in Q1 2020. Hyper-casual and Puzzle games were the most popular, whilst other genres including Arcade, Simulation, and Lifestyle also saw a boost in Q2 2020.

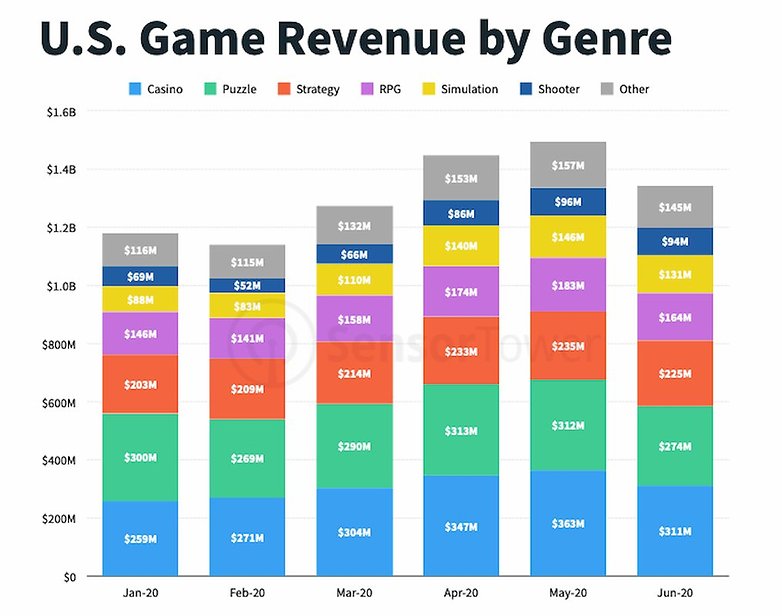

Game developers, and those who take a piece of the pie on every transaction, saw revenues go up in Q2 2020 too. In the United States, The top 200 games combined for nearly $1.5 billion in user spending in May. Business was especially good in the Simulation and Shooter games sector, which each saw quarter-over-quarter growth of nearly 50 percent in Q2 2020. Games like Fortnite and PUBG Mobile are playing a huge role here, as well as Call of Duty Mobile.

Downloadable apps are not dead just yet

We've been hearing about the death of downloadable apps for a while now. With new technical solutions maturing, such as progressive web apps (PWA), it has long been assumed that the days of the downloadable app, and thus the Apple App Store and Google Play Store, are numbered. Add to that the current backlash over the way both Google and Apple handle payments on these monopolized platforms, tensions between the United States and China leading to apps being banned in some regions, and the rise of the Huawei AppGallery, you'd be forgiven for thinking that we are on the bring of a new era for apps. That the boom-bust cycle is about to reach its inevitable conclusions.

Whilst I still think that PWAs will replace downloadable apps in the future, the app trend data from Sensor Tower suggests that apps are not dead just yet. Cloud computing and 5G are already here, but are far from widespread technologies, and it seems people still hit the apps store when they need a software solution on their mobile in 2020.

A quick word on methodology

The data in this report comes from the Q2 2020 Store Intelligence Data Digest by Sensor Tower. Figures cited in this report reflect App Store and Google Play download estimates for January 1, 2012 through June 30, 202 Download estimates presented are on a per-user basis, meaning that only one download per Apple or Google account is counted towards the total. Re-installs of the same app by the same user are not counted towards the total, nor are updates or downloads by the same user on multiple devices.

What do you think about these app trends of 2020 so far? Any surprises? What do you predict for the future of the app market in Q3 and Q4 and beyond? Let us know below the line.